We are all familiar with the concept of buying something we hope we will never need. We buy insurance for our homes, cars, and ensure against disability while hoping we never have to file a claim.

A prenuptial agreement has a lot in common with an insurance policy.

Insurance policies pay for catastrophic and unexpected losses. Insurance policies make it easier to get through difficult situations. A prenuptial agreement does these things for something we are at far more risk of experiencing than a house fire. The risk of injury in a home fire large enough to be reported happens to only 1 out of 89 people over a lifetime.[i] Even with the lowest odds of divorce, if you marry, your risk of divorce is greater than that of having a serious fire.

We often hear that half of all marriages end in divorce. While this statistic was somewhat accurate at one time, it was never a meaningful statistic. There are many factors that impact the success rate of a marriage. The expected success rate for some marriages is as high as 78%.

The factors that influence whether a marriage will continue are largely related to stress. When someone does not have a lot of skills or education, life is more stressful because it’s more difficult to make enough to pay for necessities and because the adaptive skills that make life easier when someone has more knowledge aren’t known by the couple that is attempting to get along.

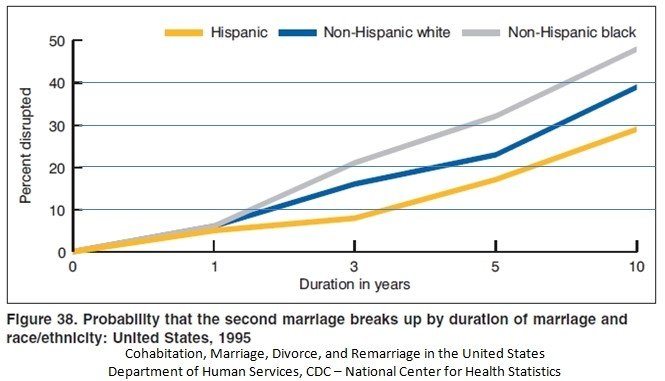

Second marriages end in divorce more often than first marriages

They also often involve children from a prior marriage. Even if your children are adults, you may intend to leave them an inheritance from your existing assets or from assets you accumulate after marriage. A prenuptial agreement and estate planning are necessary to ensure your wishes are followed.

In addition to considering a prenuptial agreement, second marriages should understand the implications of mingling their assets if their intention is to leave part of those assets to children from a prior union. The attorney’s at McIlveen Family Law can help you understand how to protect your assets from being left to your new spouse’s relatives instead of to your children.

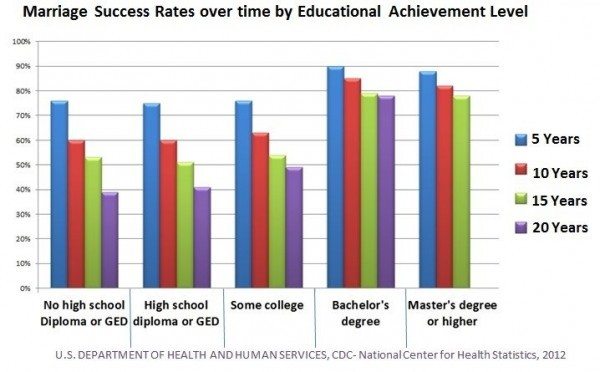

Education: Influence on Marriage Success

This graph shows that individuals who do not graduate from high school or obtain a GED have a divorce rate of over 60% after twenty years. Individuals who have a bachelor’s degree have a divorce rate of only 22% after twenty years. Although it would seem logical that additional education beyond a master’s degree would lower the divorce rate, even more, that is not what happens. Individuals with higher educational achievement may be more focused on their careers or have more responsibilities at work that distract them from the marriage so their divorce rate is slightly higher than the divorce rate for those with a Bachelor’s degree.

Individuals who completed some college but did not earn a Bachelor’s degree do not experience divorce rates much different from those who only finish high school. This could be because some college (without a degree to show for it) does not lead to a better job so the financial stress is still present. It could also be because stressful life events sometimes lead to leaving school and contribute to divorce.

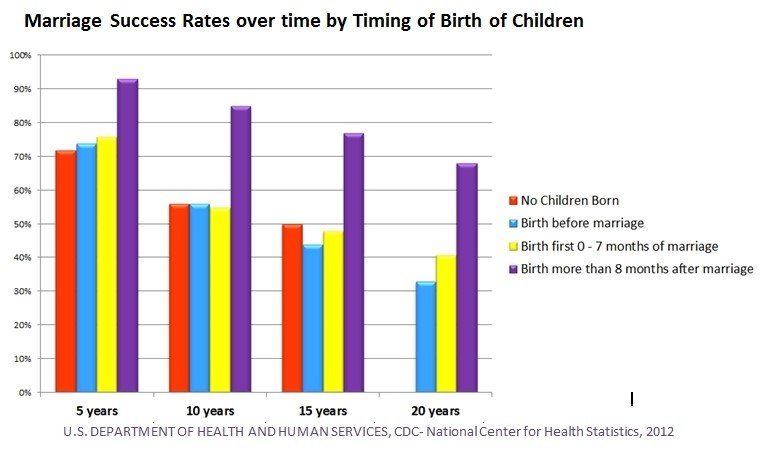

Children: Timing Influences Marriage Success

One of the stressful life events that can interrupt education and has a profound effect on whether the marriage is successful is the birth of a child. The divorce rate is highest for couples who have a baby prior to marriage and just a little better for couples who are pregnant when they get married.

Couples who have children who are born more than eight months after they marry have an overall marriage success rate at twenty years of 68%, which is much higher than the 50% divorce rate that is commonly cited. This includes parents of all educational levels and ages at the time of marriage.

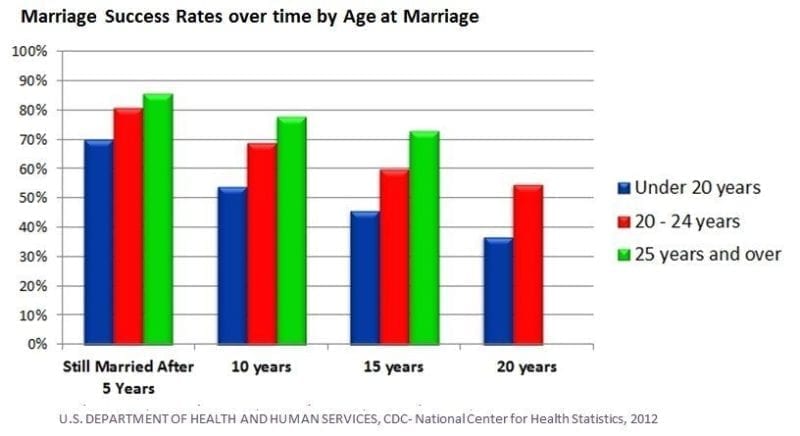

Age at the Time of Marriage: Influence on Marriage Success

The third factor with a large influence on marriage success that couples can control is their age at the time of their marriage. Couples who are twenty-five years or older when they marry fare much better than younger couples. Regardless of educational level and when children were born, 73% of couples who were twenty-five or older when they married are still married fifteen years later.

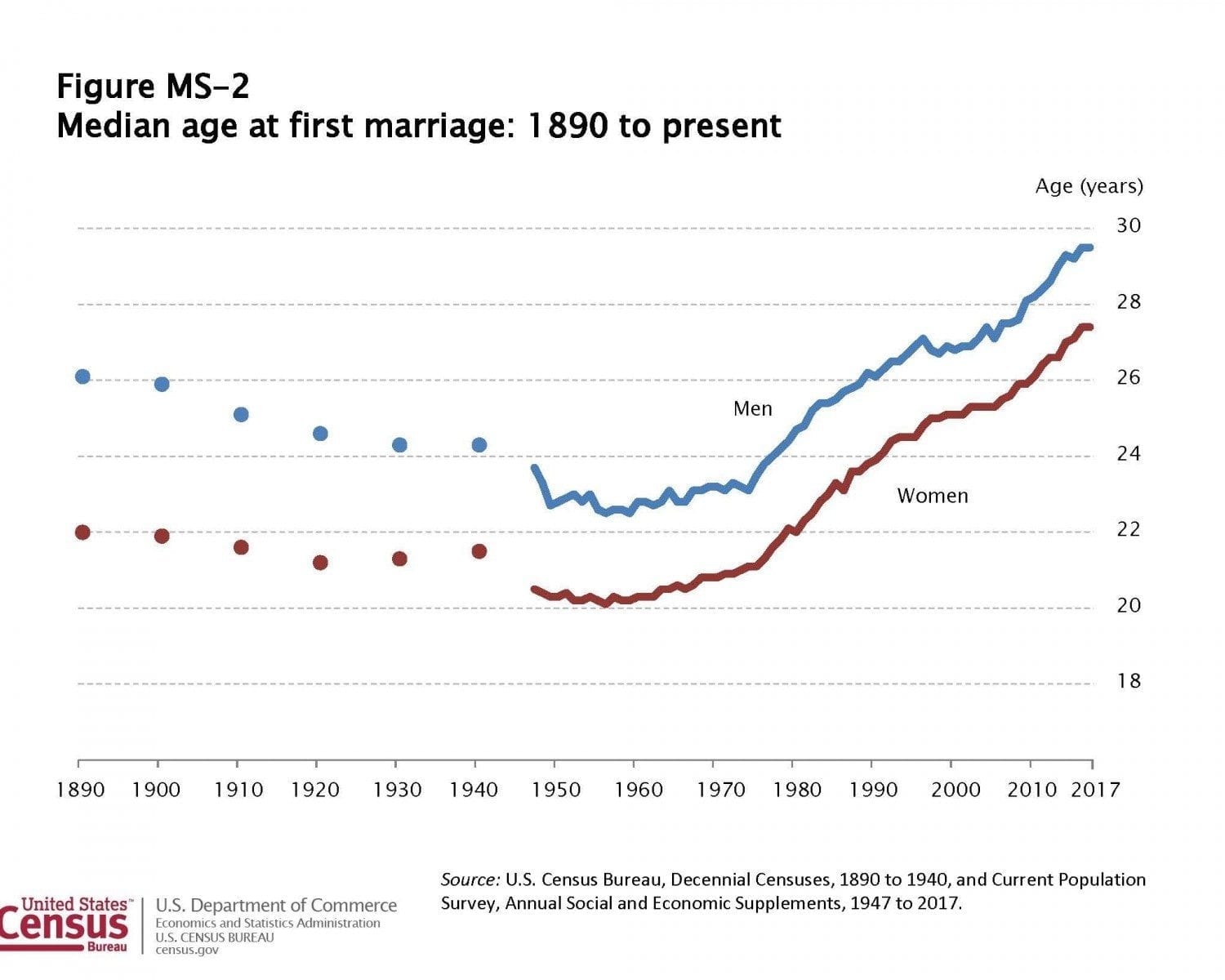

Changing Statistics

One reason divorce rates have been declining may be because the average age at first marriage has increased for both men and women. The most recent data from the US Census Bureau indicates the average age of both men and women is now over age 25 when they marry for the first time.

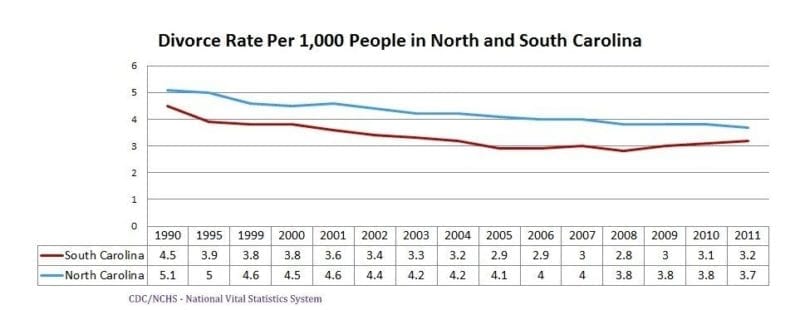

The divorce rates in both North and South Carolina have declined substantially over the past two decades.

Depending on your unique situation, your risk of a failed first marriage may be higher or lower than 50%. Even if your risk is a lot lower, it is still wise to manage the risk. One reason individuals with more education have a lower risk of divorce may be because their education prepares them to manage risks in other areas of their life. A well-crafted prenuptial will not encourage divorce and it will not create golden handcuffs that trap someone in an untenable situation. The right prenuptial agreement can reduce stress and ensure that neither person is hurt more than necessary if a divorce occurs.

Prenuptial Agreements Protect Prior Children in a Remarriage

Prenuptial agreements become more important when there are assets accumulated prior to marriage and children from a prior marriage. The risk of divorce is higher for second marriages.

Remembering that marriage is a legal contract for which the state wrote the rules unless you write your own can help you see the wisdom of using a prenuptial agreement. It is something a couple can do together to ensure that their combined wishes are followed instead of what the state thinks is right for every family. The process can also lead to discussions that help couples avoid making assumptions that lead to difficulties during the marriage. It is easier to discuss and consider alternative viewpoints before you feel as if you are stuck in the situation.

These types of conversations can increase your odds of remaining married. They can also help you identify areas that might lead to irreconcilable differences before you enter into marriage.

Risk management involves anticipating and evaluating risks and the identification of ways to minimize their impact by developing processes and purchasing insurance. In a marriage, a process could involve agreements that problems will only be discussed when both people are calm. A prenuptial agreement could be considered a form of insurance that protects both parties from court decisions that might not support outcomes either of them desires.

Family financial planning involves wisely and intelligently managing the assets and financial decisions relating to earning, budgets, investments, retirement planning, insurance, and estate planning to ensure the family’s financial safety and security.

From both a risk management and a financial planning viewpoint, a prenuptial agreement is a good decision, just like having insurance on your home and vehicle.

Contact McIlveen Family Law Firm. We are Happy to Help

If your fiancé has presented you with a prenup to sign before your wedding, contact us to help you review and understand how it may affect your rights and responsibilities.

[i] https://www.nfpa.org/News-and-Research/Fire-statistics-and-reports/Fire-statistics/Fires-by-property-type/Residential/A-few-facts-at-the-household-level